REVIEW

- Murray Horton

TONY FOMISON I need to start with a full disclosure. I was involved with this book project for more than a decade, having been first interviewed by Mark Forman, the biographer, in 2012. I am cited throughout the book, I made material available and, at Mark's request, I found two photographers - Tony Webster and Walter Logeman - who had taken photos of Tony Fomison half a century earlier.

I was among dozens of Fomison friends and acquaintances that Mark interviewed - we all had an advantage over the author, in that we knew Tony. Mark Forman never met him nor had any contact with him. In my case, I was a good friend of Tony's for a couple of decades, up until his death. I was one of three speakers at the book's Christchurch launch in June 2025. I was pleasantly surprised to be asked by Mark to speak. I said to him: "I'm not part of the art scene". He replied: "That's why I want you to speak".

Tony Fomison died in 1990, aged only 50. It is remarkable that this is the first ever biography to be written about one of New Zealand's greatest artists. But it was hamstrung by being a book about a painter with no paintings in it. Why? Because Mark couldn't get the agreement of the surviving Fomison family to reproduce any of Tony's paintings. I'm not going to go into the reasons why, that has a been a major media story in itself. I refer you to Sally Blundell's "An Empty Frame" in the Listener (21/6/25). So, this book - as its' subtitle makes clear - is about the life of the artist, it does not show the work (but does a very good job of describing it in words).

And What An Extraordinary Life It Was!

"As a boy Tony had drawn maps and diagrams and medieval battle scenes. He'd read fairy tales and been enchanted by local sites of Māori history. As a young man he was a vagrant on the streets of Paris, was twice imprisoned, spent time in a mental hospital, battled destructive addictions, and experienced unrequited love and loneliness".

"All of this would become the underworld of his art, the subterranean realm where he could dwell so as to create work that expressed something of the human condition. But it was always far wider than just his own story. Endlessly curious about Pacific and Māori history and art, and enchanted by European Renaissance art, he wanted to find a new visual language for what it meant to live in the Pacific; he wanted to make room at the back of our heads" (Mark Forman, from his introduction to the book).

Although I'm not qualified to talk about Tony the artist, that doesn't mean that I don't know anything about his art, which I love (but I was not surprised to learn from the book that he regularly used to scream in his sleep, as his paintings were, and are, often the stuff of nightmares). He hoped that his paintings gave their buyers nightmares.

Patrons A Necessary Evil

Speaking to me of his patrons among the bourgeoisie, he said: "I've got a bee in my bonnet about them; they're the swine I rely on to buy my paintings. I hope these paintings fester on their walls and they have to take them down and put them behind the piano. I hope the paintings get up and chase them around the house". He was delighted that an aggrieved 1960s' viewer of his paintings described them as "indistinct portraits of malformed negroes pictured at midnight".

In May 2017 I was invited to write a short opinion piece in the Christchurch Art Gallery's glossy magazine about my favourite work in the Gallery's collection. I chose Tony's "No", which was one of their works blown up giant size and put on a CBD wall during the post-quake years that the Gallery was closed. You can read that here (and you can actually see one of Tony's most famous paintings).

Not only was I not part of the art scene, I wasn't part of the gay scene, the boozing scene or the druggie scene (all of which is still true today). So, how did I know Tony? Because we were both part of the Christchurch Left activist political scene more than 50 years ago (and I still am today). Tony was a fully immersed member of the long gone and oft-mythologised counter-culture, which married a whole raft of different scenes - politics, lifestyle, drugs, music, underground magazines, etc. Tony was into all of that.

Tony came on the famous (or infamous, depending on your point of view) 1972 protest at the US military facility on top of Mount John, in the Mackenzie Country. He made his own unique contribution to such 1970s' Christchurch protests. He came on one protest against US bases with a homemade placard reading: 'Gay Liberation Front supports this march - so look out, us camps say 'No' to US camps'.

Owen Wilkes

Another key figure in Tony's political activism was world renowned peace researcher Owen Wilkes*. Owen worked on various Canterbury Museum archaeological digs back in the 60s and forged an unlikely but enduring friendship with Tony. They shared many harebrained adventures on Māori rock art digs (such as getting stuck together in a North Canterbury cave without any food).

In the catalogue that accompanied Fomison's posthumous exhibition which toured the country in the 90s, there is a sketch of Owen and Tony together on a dig. *My obituary of Owen is in Watchdog 109 (August 2005). And my obituary of Joan Hazlehurst, Owen's wife at the time, is in Watchdog 168 (April 2025).

To quote Tony, from my 1990 Watchdog obituary of him: "I led an expedition to Lewis Pass to look at what I thought was a Māori war canoe; Owen identified it as a colonial period pig trough". Wilkes and Fomison were the most unlikely pair imaginable, starting with their contrasting physiques, but the friendship was genuine and long lasting. One related incident leaves an extraordinary visual image in my mind - Owen, on a bike, towing Tony on his bike, into a norwester, back into Christchurch after an especially disastrous North Canterbury expedition.

The friendship with Owen led the painter into politics. "I started to decide my sympathies were Left when I saw the poverty in London and Paris. I worked for Owen (in the late 60s, at Owen and Joan's Governors Bay tomato farm) and when he wasn't picking tomatoes, he'd be up to his elbows looking for Omega stations. I was impressed...". They remained friends for the rest of Tony's life precisely because, as with Tony and I, they lived in different worlds.

CAFCA Member; 81 Tour Street Fighter

In the 1980s, Tony joined CAFCA because he found that Watchdog was the best way that he could keep up with news about Owen. But not only because of that - Tony regularly wrote to me about how much he appreciated reading Watchdog. Tony remained a CAFCA member and a political activist until his death. My obituary of him is in Watchdog 63 (April 1990) Nor was Tony's political activism confined to CAFCA, far from it. He was into all manner of campaigns, boots and all (literally, see next paragraph).

He put himself in physical danger during the 1981 Springbok Tour protests in Auckland, suffering broken ribs courtesy of violence from the Police riot squads ("they're no better than their fucking dogs!"). He was in Biko Squad, with a shield and "decent armour, cut up plastic buckets lined with inch thick foam rubber". Nor was it just for show - "I remember pushing one cop back with a boot to the balls, watching his face as I did it. No damage, he was wearing the same protector that we were".

He was a streetfighter in 81 and spared nobody if they lacked his courage. "I note that few from the gay community join the anti-tour marches, if they do, they keep out of the 'front line'. Not that they can keep from attitudinising vaingloriously about violence". His politics did not end with the tour. He lived in Grey Lynn and hated its gentrification. "I've got a spray can. God forgive me the ozone fallout of my graffitiing the walls and fences of the new moving-ins (white, professional, racist, etc)".

Seminal 1974 Canta Profile

My most intensive and rewarding interaction with Tony while he was still in Christchurch in the early 70s was the lengthy profile I wrote on him which was published in the University of Canterbury student paper Canta in 1974 (I was the Editor that year; it was originally written, in 1973, for the short-lived NZ edition of Rolling Stone, which went bust before the article could be published). I recently re-read it for the first time in decades and have to say that I consider it one of my very best pieces of writing. I can't remember anything about the actual interviews (which were all done in handwriting, then I typed them up).

I'm not going to quote from it, as it is extensively referenced throughout the book. It was the most intimate and frank interview that Tony ever gave and it was so controversial that Canta's printers wouldn't print it until Tony signed a legal waiver, witnessed by a lawyer. Sally Blundell's 2025 Listener article reproduced it: "I TONY FOMISON having read the article by MURRAY HORTON for printing in Canta magazine consider it to be correct in all ways and a true and accurate record of interviews. I authorise publication of the said article and consider it in no way defamatory and indemnify all concerned in its reproduction in Canta against all claims or demands which I may be able to take but agree not to do so" (the block capitals were in the original).

Tony gave a very unvarnished account of his life up until that point. I didn't know until I read the book that it was in the Canta profile that Tony came out as gay (he went into extremely graphic detail) - which was a crime in those days. Extraordinarily, the subject was never mentioned again in any subsequent public writings by or about him. In the article he talked in detail about his use of hard drugs (which was, and remains, a crime. He'd been imprisoned in Christchurch for using hard drugs a few years earlier.

He later kicked the drug habit but was a heavy boozer all his life, which was a major contributing factor to his premature death). If you can find that 1974 Canta article you can see a wonderful array of Fomison paintings on full display. From the 2025 Listener article: "There were no secrets with Fomison, Horton says. 'He wasn't leading a double life. He wasn't a closet something or other'... A scholarly book on Fomison, says Horton 'would be completely out of sync with him - and frankly boring'".

Llew Summers

Tony permanently moved to Auckland in 1973. I remained a good friend with him during the 17 years he lived there up until his 1990 death. We visited each other and we had friends in common. One central figure in the book is Christchurch sculptor Llew Summers. Tony was his early mentor when Llew was starting as an artist, they spent a lot of time together, their families lived across the street from each other in Tancred Street, Linwood, for years. Llew was a lot more involved with this book project than I was, providing a lot of photos and his presence is felt throughout the book, as is that of the whole Summers' family.

I knew both Tony and Llew as good friends for decades. Llew and I travelled to Auckland together to attend Tony's unforgettable three-day funeral in 1990. Llew was also a political activist, and a CAFCA member, for decades. Sadly, he died in 2019. My obituary of him is in Watchdog 152 (December 2019). On the other hand, Llew only had to wait a year for his posthumous biography; Tony has had to wait a remarkable 35 years for his first ever biography. I reviewed "Llew Summers: Body And Soul" in Watchdog 155 (December 2020).

I met several members of Tony's family. I met his Dad once and a couple of sisters. Indeed, for the year of 1979, I lived, with Bill Rosenberg and Dianne Paine, a few doors along from his family home in Tancred St, Linwood (Llew Summers and family lived across the street). I regularly visited Mrs Fomison (nobody ever dared to call her Mary) for years before and after Tony's death.

She and I had diametrically opposed world views - Tony once told me he'd temporarily stopped speaking to her because she supported the 81 Tour and voted National that year - but she and I got on fine. Very recently I was going through personal papers I have about Owen Wilkes and came across a hand written note from her, thanking me for sending her my obituary of Owen. Mrs Fomison outlived her son by 30 years, dying in 2020, just short of her 100th birthday.

The book bought back so many memories for me. Wherever Tony lived, in Christchurch and Auckland, he made the houses highly idiosyncratic and unforgettable. To give just one tiny example - he collected and proudly displayed egg cups. When I asked him why, he replied, with a straight face, that he'd read somewhere that it represented a sublimated quest for the Holy Grail (alternatively, he might have just liked eating lots of eggs). I can imagine the horror of his suburban neighbours in both cities - not only was he a drug addicted, alcoholic, homosexual, communist artist weirdo but, even worse, he didn't mow his lawn.

I stayed in his Auckland homes and can vouch for the squalor in which he lived and which the book describes in excruciating detail. Tony lived the life of the bohemian artist to the nth degree and had artist mates who did the same. I met two of the most high-profile of them, Phil Clairmont and Allen Maddox, and had suitably bohemian adventures with them, in company with Tony (both of them are also long dead).

Immersed In Samoan Culture; Full Body Tattoo

When Tony lived in Auckland, he got right into Samoan culture. He and I had a mutual interest in Samoa - he in the culture; me in the history. I attended one of the painful Auckland sessions whereby Tony got his full body traditional Samoan tattoo (a pe'a), turning himself into a living Pacific artwork (the tattooist described the process to me as feeling like "a hot iron up the arse").

That tattoo gave Tony extraordinary mana within the Samoan community and he could say what he thought, sometimes skating on very thin ice. To quote from my obituary of him in the NZ Monthly Review (March 1991) "... the graveside oration was delivered by a Samoan pastor in lavalala (Tony had forbidden him from wearing a suit). The pastor told a story illustrating Tony's absolute fearlessness.

"He had told Tony he didn't understand Tony's paintings. 'That's because you're a stupid Samoan pastor', was Tony's reply. Every Samoan around the grave roared with laughter". Tony made his own body a canvas. A number of his friends, including me, received a gift of a small framed piece of cloth used to wipe the blood and pigment off his tattoo in progress and thus retained that bit of the pattern. Mine was signed, and described as "part of leg, 1979".

A couple of things in the book surprised me. It says that the wives and partners of some of his friends didn't like to be around him, because he could be obnoxious to them. I never saw any evidence of that with regards to my then partner, Christine Bird. On the contrary they were good friends and she was (and remains) a great admirer of him and his work.

For his part, Tony gave her a small, hand inscribed and signed painting for her 30th birthday. He was famous for painting on found objects - this one was on a wooden teapot stand. She loved it. The other surprising thing the book does is quote various of his friends who said they didn't miss him after he died. Not me. I wrote, in my Monthly Review obituary: "What a great loss the nation has suffered, what a great friend I have lost!"

Tony was a most assiduous correspondent (snail mail in those days) and I have a treasured collection of personal letters from him, spanning the 1980s. To quote my Monthly Review obituary again: "He lives again through those pages, in his unique sloping spidery handwriting. And they are so alive, so opinionated. His painter's eye can transmute the written word":

Impressions, Opinions & Adventures

"'I've just come inside from the sunset, perched in the pohutukawa tree, wish it was big enough to live in... In the meantime, I was looking up at a sky both blue and red streaked, half a pale moon floating in it, edged by that layard tree's first Christmas flowers. Soundtrack - the Tongans practising an oratorio and birds who forgot I was there. I forgot I was there. I became invisible (it got dark)'".

"His political opinions were always forcefully expressed. 'You're in the reluctant throes of a royal tour! (I was in the dunny this morning, with the transistor, the strains of an imitation English choir service from the Christchurch Cathedral wafting out of it just as I was wiping my arse')". Some of his stories were hilarious and horrifying at the same time.

"...' when a couple of friends dropped me - they were carrying me at the time - my cracked ribs cracked again - we were all so drunk we couldn't find where the front door key was stashed so they left me wrapped in newspapers from the stack on the verandah, crashed on the waterlogged armchair next to the front door - the key was in a hole in that very chair's stuffing'. Nor did he spare himself. 'It wasn't until later that I realised that for the last three days I'd been wearing a lavalava - not your genuine 'Made in Hong Kong', but the cover of an old mattress cut in half. Don't know how I get away with it'".

Proudly Working Class

The book has created an extract from that 1991 Monthly Review obituary: "Tony was that great rarity, a true original. Yes, he was a boozer and a junkie. Yes, he could be an obnoxious little bastard (although never to me) who got into fights, metaphorical and literal. He made plenty of enemies. He was a gentleman, but never a gentle man. Quite the opposite. He had a gut understanding of politics, he was prepared to put himself in the front line, he never forgot that he came from the working class" (although I suspect that his life would have been very different, and New Zealand art would have been much poorer, if he'd followed his father's wishes and become an apprentice boilermaker).

REVIEWS

- Linda Hill FULL EMPLOYMENT

Life Of The Artist

by Mark Forman, Auckland University Press, 2025

Can The New Zealand Economic Miracle Last?

by Wolfgang Rosenberg, 1960

THE MAGIC SQUARE I picked up Wolf Rosenberg's 1960 book from a Men's Shed box at the Featherston bookfair, and it cheered me up from BS Budget gloom. Any other economic world is possible - we had a very different one in 1960! What I like is that, in 1960, Rosenberg is writing from within an economy in which full employment and industrial development have been achieved under both Labour and National governments for more than 20 years.

0.25% Unemployment Rate

In July 1959 our unemployment rate was 0.25%, the highest for 20 years, compared to 2.6% in Australia, 3% in the UK, 7.7% in the US and 8.4% in West Germany, for example. New Zealand was showing the world that unemployment was unnecessary "if some of the shibboleths of free enterprise and laissez faire are thrown overboard". This was the "economic miracle" before the "unfortunate experiment",1 and Rosenberg explains how it was done.

He begins with a quick account of our earlier economic history. New Zealand was developed on the basis of John Locke's and Julius Vogel's formula of "land, labour and capital" - Māori land, cheap immigrant labour, and borrowing on the London market.2 Two liberal principles governed economic policy prior to 1935, he says: i) free movement of money in and out of New Zealand, and ii) never interfere with prices, except to avoid inflation.

Overseas debt grew steadily as our imports, paid for with pounds sterling, exceeded export earnings. Our growing agricultural economy became dependent on, and vulnerable to fluctuations in, overseas commodity market prices, often affected by events outside our control. When the 1930s' Depression hit and our exports sales nosedived, the banks reduced credit to the Government as well as to private borrowers.

Economic activity and demand for imports was reduced but the interest and capital repayments on our £76 million historic debt continued as a "leg iron" on Government. In 1933, 80,000 men were officially registered as unemployed, but it was probably closer to 100,000 - near a fifth of the male working population. Legacies of this, Rosenberg says, were a distrust of banks and horror of unemployment by many New Zealanders, and a shared policy goal of full employment by political parties.

Causes Of Unemployment

He discusses the general causes of unemployment. As well as seasonal work and low immobility of workers - the Labour Department gave some assistance on these - the causes of unemployment include insufficient demand for the nation's production, which may be the result from businesses "ploughing back" profits or households saving their money, rather than redistributed it as wages to become purchasing power, increased consumption and thus more jobs.

Unemployment is the outcome of low consumption, low investment activity, Government surpluses or balanced budgets and a surplus of imports over exports, he says. Stimulation of investment activity, deficit spending by Government and export surpluses are the main sources of full employment. So, from 1935 Labour set maximum interest rates on all savings and increased Government spending on infrastructure and social supports, funded at nominal cost by its own Reserve Bank.

However, high consumption, high investment and high Government expenditure tend to provoke inflation and foreign exchange crises, as demand pushes up prices and imports.3 In private enterprise economies, the possibility of achieving an exact balance between full employment and inflation "is obviously fairly small", he says, and "inflation was one of the causes of the widespread defeat of Labour" parties around 1950.

After WW2 most of the capitalist world returned to zig-zagging trade cycles causing high and low employment, but New Zealand maintained its post-Depression goal of full employment and addressing the problem at the level of its foreign exchange accounts, "with commendable flexibility". Demand was dampened down as required, not by unemployment but by limiting import licensing to what we needed and what we could pay for with our exports to often-volatile commodity markets. Social supports and wage/price policies at home included Government assistance with price stabilisation mechanisms for farmers.

Keynesian, Or Not So Keen

The above summary doesn't do full justice to Rosenberg's explanations and arguments. But so far, so Keynesian. Keynes added income and consumption to the economic debates of his day. He viewed both savings and consumption as dependent on income levels, which in turn depended on investment - both public and private - and its multiplier effects. *John Maynard Keynes (1863 - 1946) advocated Government spending on public works to stimulate the economy and provide employment. He was the most influential Western economist for several decades after World War 2, until he was supplanted by the monetarists. Ed.

However, while seeing an investment role for the State, Keynes "did not think in terms of struggling economic classes", Rosenberg points out. Let alone in terms of changing the class structure of society by harnessing the State, as pre-war Labour parties did.

Clara Mattei has unpicked how, after WW1, monetary, fiscal policies and labour relations policies (high unemployment) were used in the UK and Italy to defeat rising socialist movements.4 After devastating unemployment in the 1930s, New Zealand governments did the opposite. They used monetary and fiscal policies and corporatist labour relations in support of their goals of full employment and greater equality.

Government Was Hands On In Those Days

What strikes me about Rosenberg's account is how actively both Labour and National governments used policy mechanisms to balance and direct the complex dynamics between imports, exports, demand and savings, public and private investment, employment and inflation. Today these seem to be merely economic indicators that Governments report on, like the weather, but do remarkably little to change. It's hands-off economics by hands-off Governments. One of Rosenberg's chapters is a detailed analysis of policy adjustments and outcomes in 1958-9, in response to a sharp drop in commodity prices overseas.

The interventions and interactions described were complex, but so too must be the largely invisible workings of "hidden hand" free market economics directed at maximising profit, not employment. These days the whole economy is expected to respond ("steered not rowed") to the interest rate on reserves that banks are required to hold, set by a central bank that is legally independent of Government. National and Labour dispute only whether the Reserve Bank Governor's criteria can include the unemployment rate, as well as the inflation rate.

Were import controls so terrible? I remember in the 1960s everyone complained about the waiting list for cars; you could choose the make but not the colour. Mostly grey now anyway, aren't they? You had to apply, with reasons, for a licence to import goods, or for permission to send money overseas. But perhaps licensing controls were directing imports to what we needed, such as machine tools, as much as restricting them. My father had a story about going to Wellington soon after WW2 to get a licence to import laces and other materials suitable for babies and toddlers. Expecting to be knocked back, he tripled the number he first thought of - and got the lot.

Not frivolities; Government-directed supplies for the baby boom. By 1960 we had State-built houses, Fisher & Paykel appliances, a car per family and a full-time male wage was enough to pay for it all. A prosperous and more equal society by international standards, and later5 Rosenberg links full employment to important social health outcomes, which fluctuated together between 1938, 1967 and 1983. Well, okay, not equal for women or Māori, which Rosenberg doesn't appear to notice, but we got onto that in the 1970s.

Threats To Full Employment

One of the "basic threats to full employment", warned Rosenberg in 1960, was pressure to join the International Monetary Fund (IMF). As a "lender of last resort" since 1944, the IMF has considerable informal power to require policy "adjustments", and its primary concern - like Keynes's - is the maintenance of free trading and currency payment systems through "the utmost possible reduction of exchange restrictions".

Rosenberg quotes extensively from IMF Directors about its role ensuring "the observation of monetary discipline". In the eyes of the Fund, Rosenberg says, Government finance should be used to prevent inflation, taking restrictive measures before "over-full employment" develops. A pretty basic clash of values with New Zealand's at the time. Another basic threat to full employment, he says, was "the complacency of New Zealanders", and lack of recognition that we had achieved "something that no other country in the world had achieved equally well".

Threat Of Foreign Investment

Rosenberg's last chapter is about another leg iron: foreign investment. Secondary industries initiated under the first Labour government to reduce imports were followed by heavier industries - pulp and paper, iron sands, aluminium - made possible by advances in chemical engineering. These could diversify the economy, but the fruits might not remain in New Zealand as foreign investment increased in the 1950s. He points out how foreign investment affects the overseas balance of payments differently from Government borrowings offshore.

Initially, both profits from overseas investments and interest on Government loans from overseas are "invisibles" added to payments for imported goods that have to be balanced against New Zealand's income from exports. But any private profit retained here and reinvested will then have a rapid cumulative effect on the outward flow of profits, in a way that Government borrowings do not. A table shows the growing effects of foreign investment, of both kinds, on our balance of payments between 1950 and 1959 and its diminishment of our exchange reserves. In 1958-9 the Government borrowed a quick £20m to cover a potential short fall.

These investment servicing payments took a much shorter time to exceed actual capital inflow than in our earlier history. In 1959, the cost of offshore borrowing was around 7.5% of export proceeds, so not excessive, he says. But he points to the worse situation of Australia and Canada, who had gone down this route earlier. He quotes an Economist article of March 1960: "The deficit on merchandise trade at least fluctuates... But the invisible account, dominated by debt service, dividends and payments for business services, leaps up remorselessly year by year". It was this threat that led to the Campaign Against Foreign Control of Aotearoa, whose 50th anniversary we are celebrating in 2025. Rosenberg was a founding member.

End Of The Miracle

No, the economic miracle didn't last. Perhaps we stopped believing in it. We joined the IMF in 1961, and began to do as we were told. Unemployment rose from 1967 when Rob Muldoon as Minister of Finance began liberalising foreign transaction and import controls for greater "freedom" and "restructuring" in favour of industry, for "international competitiveness".

When Britain devalued sterling in late 1967, we dropped our currency to the level of the Australian dollar and decimalised it. That shrank my OE savings by 19%, but no doubt helped balance the foreign exchange account. A raw materials boom helped the 1972-75 Kirk/Rowling years, but then came the OPEC (Organisation of Petroleum Exporting Countries) oil embargo and it was "borrow and hope". In 1974 our overseas indebtedness was 55% of exports, with 995 registered unemployed. By 1984 it was 160% of exports with 84,000 unemployed or 120,000 including make-work schemes.6

When I got home in early 1983, I read in the New Zealand Herald the same "Washington consensus"7 advice from the IMF that I had read a few months earlier in a Bolivian newspaper. In 1984 we voted for nuclear free and got free market economics with it, in an unexpected swipe from the Left. The New Zealand dollar was immediately devalued, and a series of monetary and fiscal changes followed. Banks, imports, overseas remittances and private borrowing offshore were all deregulated, and the finance sector boomed.

Supports to farmers were removed, prompting suicides. Tariffs that supported local manufacturing jobs ended under Closer Economic Relations with Australia, and began to be reduced under GATT (General Agreement on Tariffs and Trade) and a series of Free Trade Agreements. A shift to "an open economy that works on free market principles", as Treasury now describes us.

The Magic Square

Against this tide of monetary deregulation, Rosenberg published "The Magic Square" in 1986. He shows the fall in New Zealand's international rankings in the 1960s and 1970s as we slowly "restructured", with international competitiveness as our first priority. He explains the "disaster of Rogernomics" sudden abandonment of economic instruments' controlling foreign payments, and its reliance on a "sole blunted instrument: control of money supply" through the base interest rate. In mid-1972 18 countries had abandoned the Bretton Woods gold-standard system8 and floated their currency - in effect, privatising international financial flows.

In 1984 the Labour government did the same, and tried to balance foreign exchange by attracting inflows of foreign money with extremely high interest rates.9 Our overseas debt, public and private, swelled from $16.1 billion at the end of Muldoon's term to $28 billion in December 1985. The financial sector boomed, but the economy didn't. It stagnated between 1985 and 1993, with very average growth since. "Rogernomics was an abject failure by its own standards'" says Easton in 2020.3

Rosenberg lists and discusses Labour's rapid monetary policy changes in late 1984-early 1985. He unpicks the neo-liberal theories, assumptions and fallacies behind them, providing historic and contemporary data. He also provides lessons from Argentina, Chile and Uruguay, which had already gone down this route on IMF advice. "The question of full employment does not arise in this theoretical model". It's all well worth reading, but it won't cheer you up - the same neo-liberal mind set is still evident in the 2025 Budget.

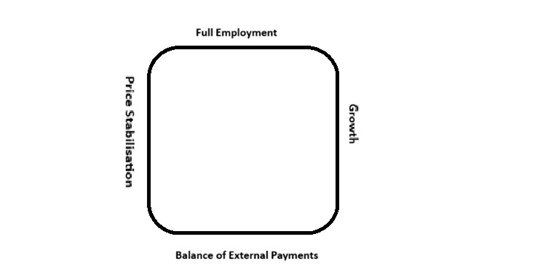

He also recaps and expands his arguments on how to support prosperity through full employment. The problem with leaving decision-making to "the market" is that it cannot solve the basic dilemma of economic policy: how to achieve four objectives simultaneously. This time he presents these four objectives as a useful diagram: the "magic square".

Note, this is not a matrix of paired opposites. Each policy side of the square has its own tensions and balances to resolve, as well as contradictions between the four policy areas. To maintain employment and prosperity, the four must work together, with flexibility, to reduce the impacts of whatever crisis the world is throwing at us - commodity price drops, financial crises, pandemics, regional wars, tariff wars. I visualise "the role of democratic government" in the middle of the square, and "the global economy", with lightning bolts and dragons, around the rim of our Pacific hemisphere.

"No policy which does not successfully control all four variables will be durable," says Rosenberg. This cannot be done with a single monetarist instrument - such as the present base rate for bank credit increasing or reducing economic activity and inflation. "What growth - if any - that they are able to achieve will be partial and badly distributed - with any benefits flowing to a small privileged class of New Zealanders". And so it has been.

Washington Consensus & Business Roundtable Prevailed

Rosenberg's 1986 analysis and advice were of little avail. Contrary to assurances in election campaigns, the monetary policy changes were followed by fiscal and labour relations changes. In its second term (1987-90), Labour "rolled back the State" through State sector restructuring and privatisations, with "reviews" of health and education. National followed with savage benefit cuts, and the repeal of a new pay equity Act and our whole 100-year system of occupational wage bargaining.10 Voters tried to hit back with a change to proportional representation. But the Washington Consensus agenda, and most of NZ Business Roundtable's wish-list, had been achieved.

Two leg irons now hold these neoliberal policies in place: the Reserve Bank Act 1989 and the Public Finance Act 198911. As I write, we are probably about to get a third: the Regulatory Standards Act. Together these ensure that New Zealand is just another a low wage, resource-exporting former colony, designed for dependence on the global economy. In a world order which is increasingly chaotic. Kiwibank's June 2025 Economic Forecast warns that: "As a small open economy, we're especially vulnerable... And the way we see things, the balance of risks is tilted to the downside".12

Unemployment By Design

For four decades, economists have been running New Zealand at 3-5% unemployment as normal. There's a fictional number called the NAIRU, the Non-Accelerating Inflation Rate of Unemployment, below which jobs and wages are held responsible for price inflation. Jobs vs inflation; no external factors considered important. Even so, our independent Reserve Bank may once again by law only consider inflation, not employment, in setting the base bank rate through which indirect means our entire economy and its place in the global economy is expected to be fine-tuned.

At the 2025 Budget, the official unemployment rate was 5.3% - "Oh, good," said Prime Minister Luxon on that night's TV news, before saving himself by saying he'd feared it was worse. It is worse. Part-time employment is growing faster than fulltime, and 12% of all employees want more hours of work (and pay) than they're getting. There's a statistic on "time in current job" that tries to measure the "churn" of employees through increasingly casualised jobs and stints of unemployment. This "labour market flexibility" is disproportionately provided by young people and low paid Māori and Pasifika women13, but the "gig economy" is also undermining the security of the middle classes.

As Bill Rosenberg emailed me about his father's book: "The opening of the economy, particularly in the way it happened, undermined one of the tools he counted on - import controls - to ensure the current account didn't blow out, increasing New Zealand's international debt and making New Zealand's policies susceptible to pressure from the international lenders, and making the economy susceptible to balance of payment crises which would undermine support for full employment".

Bill points out it would be much more difficult to apply the magic square now, although there's glimmer of hope in Trump's use of tariffs, intended to create more US jobs for his voters. Trump won't achieve that because he has no proper industrial policy; without it tariffs won't work. To be used for that purpose, they should be narrow and focused, the opposite of the chaotic way Trump is handling them with tariffs across the board. Wolf would have regarded tariffs as a poor cousin to import controls, he says, but would probably welcome them if used in a sensible way.

Are These Books Outdated?

I don't think so. Anything that shakes our economic ideas out of neo-liberal paralysis has got to be useful. Many scientists, economists and activists are saying that, to reduce fossil fuel use and global warming, we must shift our economies away from endless pursuit of growth and investor profit. Rosenberg's strong view that Government's role is to ensure full employment and shared prosperity would mean a step forward for most of us.

UK economist and tax haven researcher Richard Murphy is on the same page, in a 2025 talk on how modern fiat currencies work. Governments control money supply and inflation within their own economy, he says, when they spend into the economy - for whatever purpose, Left or Right - then tax it back. "If you understand this, then the goal of Governments in economic management is ... active fiscal policy ... to create full employment and price stability, not balanced budgets".14 To do so in New Zealand, all four sides of the magic policy square must be in play. Both books are in the national library and university systems. "Full Employment" is now out of copyright. Bill Rosenberg has a spare copy, if you are quick.

Footnotes:

TAIRĀWHITI In this excellent BWB Text, Aaron Smale (Ngāti Porou, Ngāpuhi, Pākehā)1 expands his Newsroom coverage of the impact of the 2018 Queen's Birthday Weekend storm, and Cyclones Hale and Gabrielle (both 2023) on the land, infrastructure and fisheries along Ngāti Porou's coast. He draws on interviews with whānanga and others, and delves into the "convoluted politics, economics and science of what led to the disaster that is unfolding and will continue to unfold for generations".

This disaster was "more than 100 years in the making". The fragile geology of these erosion-prone hills has been well-researched since pastoral farming began under a mix of Māori, Crown and Pakeha ownership in collective, freehold or leasehold title. Suspended sediment in the rivers, washing out to sea, increased by 660% once headwaters were deforested. (Full disclosure: in the 1920s my grandfather had a sawmill clearing native trees from the hills behind Gisborne on Government contract.) When the Tokomaru freezing works closed in 1952, pine forests were planted - and clear-felled in time for Cyclone Bola in 1988. The solution to massive slips was to plant more pine trees, subsidised by Government until 2020 - then clear-felled in the last five years.

The State Forest Service was dismantled back in 1987, and over the past three decades the ownership or the "cutting rights" of many production forests has passed to overseas investors. Jobs for locals occur at the beginning and end of 25-30 year growth cycles. In Ngāti Porou's rohe, "probably 70-80% of forests" are foreign-owned. "The Coast has been battered for years by decisions made by those who don't live there and don't have any connection to the place", says Smale. And who don't comply with the harvesting conditions of their resource consents.

One detailed example is Ernslaw, which has forestry interests in 93,759 ha. in New Zealand, including 23,271 ha. on Crown land licensed for 13-59 years. It is owned by the Oregon Group, which belongs to the Tiong family in Malaysia, with forestry interests and alleged bad practices in a range of countries. After the 2018 Queen's Birthday storm, the Gisborne Council had to get a search warrant to inspect slips and slash in Ernshaw One's Ūawa forest.

Ernslaw One's lawyers dragged out the Council's criminal prosecution for major damage to the environment, and to public and private property. In 2022 it suddenly pleaded guilty and was fined $325,000. Ernslaw One's income in 2022 was $41 million, and $74 million the previous year. Ernslaw's total revenue in 2022 was over $347 million from forest products, and over $121 million from sale of forests. (Ernslaw One was a 2004 Roger Award finalist for the Worst Transnational Corporation Operating in Aotearoa/New Zealand. Ed.)

Three million tonnes of logs are shipped out of Gisborne each year, together with hundreds of millions of dollars in profits. Between October 2018 and May 2022, the Overseas Investment Office granted 110 consents to acquire 240,539 ha of land under a new Special Forestry Test. Of this, 90,667 ha. were first overseas purchases from New Zealanders; 189,949 ha. were existing forests; and 50,591 ha. was farmland of which roughly 31,400 ha. would be planted in new production forest. Locking up more land in 30 year plant-harvest cycles. The profits extracted are not just from logs. There's now a less tangible but very valuable asset and income stream: carbon credits. A large share of this goes to overseas forestry owners, who leave their mess behind. Ernslaw earned $52 million from carbon credits in 2022 alone.

ETS A Political Tool

Smale calls carbon credits "a manufactured financial instrument" and the Emissions Trading Scheme (ETS) "a political tool masquerading as a free market solution". He says offsetting emissions with increased forestry is a "theoretical" solution that doesn't work. Replanted forests grow and absorb carbon too slowly to help meet our 2030 Paris target. Governments under both Labour and National plan to buy offshore credits, rather than face down our agriculture sector, especially Big Dairy, and regulate its huge CO2 and methane emissions. Does New Zealand expect Tairāwhiti to subsidise agricultural exports, Smale asks, by continuing a land use that causes catastrophic damage to the environment and to coastal communities?

No Reset For Forestry

In April 2025 the Parliamentary Commissioner for the Environment, Simon Upton, released a report2 on forestry, calling for a policy "reset". He says the Government needs to radically change the design of the ETS, which is "mostly a tree planting scheme" that does little to cut planet-heating gases. Current settings will drive the planting of so many carbon forests that in 10-15 years the carbon price will plunge, causing the ETS to collapse.

The report's recommendations include:

Climate Change Minister Simon Watts responded that the Government has no plans to revisit the inclusion of forestry in the ETS. This "no" to a forestry reset came in an interview announcing the axing of another climate policy structure: the NZ Green Investment Fund.3 Established with $100m from Treasury in May 2019, this independently managed fund has been underutilised but turns a profit.

But the current Minister says: "It's time to leave green investment to private markets". Including green pine trees. The Minister has apparently not noticed the growing global4 and local evidence - e.g. BlackRock folding up Zero Solar, Z's sale of Flick, Todd Energy backing off Taranaki carbon capture and storage - that private money will invest in renewables and "green deals" only if, and for as long as, profits are sustainably high.

Footnotes:

THE CONFUSION BETWEEN SAVINGS AND INVESTMENT IS MASSIVELY HARMFUL TO THE ECONOMY This short YouTube video may be an eye-opener for CAFCA members - and quite possibly for the Overseas Investment Office (OIO). Murphy is a former chartered accountant who campaigns on issues of tax avoidance and evasion. He was a founder of the Tax Justice Network, of which Tax Justice Aotearoa is an offshoot. I learned a lot from his excellent books "The Joy of Tax" (2015) and "Dirty Secrets: How Tax Havens Destroy The Economy" (2017).

Financial journalists and commentators, and the financial services industry generally, constantly confuse the terms savings and investment, says Murphy. When someone puts money in a bank account, a pension fund or company shares, those are forms of saving, not investing. Their reasons for doing so are primarily to put money aside for something they'll do or need in the future, and because customarily they'll be paid interest or a dividend.

A third characteristic of savings is liquidity. They want their money to be available when they need it - even if it's a fixed term deposit rather than "on demand", or if they sell their shares, or they get it back on retirement. In the vast majority of cases, says Murphy, savers are indifferent to what use is made of that money. Not many people choose ethical savings and green investment funds. Most keep their savings in their own bank, or in another bank for higher interest or because they've reached the Government guarantee limit per bank (UK £85,000; NZ $100,000). Few ask what the bank does with their money. And, no, it doesn't lend it out to its other customers, as the Bank of England has acknowledged since 2014.2

Not Investment In The Productive Economy

Similarly, the shares that people buy are not investment, he says, because they will almost certainly have already been issued by the company. Listed companies seldom issue new shares; in fact, some buy shares back to push up the price of those they still hold. Only new shares - capital being invested in a new enterprise, or profit being ploughed back into equipment, infrastructure, expansion etc. - is actually investment.

What shareholders buy and sell on a stock exchange is savings (which pays a dividend) and/or speculation (for a capital gain), not investment in the productive economy, says Murphy. "The company whose name is on those second-hand shares actually gets nothing from the money that you save in the shares that it created. There is no connection between your savings and money used for investment".

Investment, he explains, is expenditure on creating new companies, new assets, new resources, that are going to be used in the productive economy. For a Government, that's more investment in transport, infrastructure and power generation, in schools and hospitals. Inside a company, it is investment in IT (information technology) and vehicles, or in education and training because trained people are needed to produce the goods and services that we want. These are all investments that create new outcomes in the real productive economy, says Murphy. "Investment is an indication of our hope for the future. There's a risk in investment - we might not get the return that we expected. This is why Governments sometimes take the risk, because capitalists can't afford to do so".

Insufficient investment has been a characteristic of the British economy for a very long time, he says. Financial services are almost entirely for savers, not investors of new capital. The City of London is focused upon the creation of savings opportunities and skimming off part of the return on savings, not on the creation of funding opportunities for investment. This sector needs reform and heavier taxation, says Murphy, to avoid the current waste of resources and people. "The City of London3 has made itself incredibly rich by talking about savings as if it is investment, as if there were social value in it".

Murphy doesn't mention private equity funds, in which asset management firms pool and profit from money from mainly pension funds and high worth individuals. In his terms, these "investors" are seeking returns on savings - it is largely rentier capitalism, not productive investment. In New Zealand, overseas companies and private equity funds are acquiring existing assets (sensitive land and/or significant business), with some new development capital occasionally mentioned but not required for OIO consent.

Need To Reconnect Investment And Savings

"We have to reconnect investment and savings", Murphy says. People need to be offered savings accounts that are guaranteed to result in investment. Banks and pension funds should be required to inform all account holders exactly what their savings are being used for, and about the bank or fund's investment policy. In the UK, four types of Individual Savings Accounts (ISAs - cash, shares, innovative and lifetime) are tax free on interest up to certain limits, to encourage saving. Murphy proposes that these tax breaks be only for funds invested in the green transition, which currently requires massive investment. The total capital saved in tax-free ISA accounts by ordinary people could fund the change needed.

Murphy is an Emeritus Professor at Sheffield University Management School, Director of Tax Research LLP and author of a Funding the Future blog. He was a founder of Tax Justice UK. His YouTube channel provides short, clear, topical talks on economics, tax, accounting, and a New Green Deal for the UK. His 14-minute YouTube on "secrecy jurisdictions" is also of interest in regard to overseas investment.

Footnotes:

REVIEWS

- Greg Waite NEW BOOK REVIEWS Today we are surrounded by versions of the truth. They range from subtle distortions to bolster the world-view of the rich (mainstream economics, newspapers and news) to outright misinformation (Right-wing junktanks and social media campaigns). But a good book still needs a coherent, holistic and evidenced view of its topic to sell copies. A good book leaves you understanding that one part of the world better than you did before.

Sadly, it's not easy finding good books these days. Whether fiction or non-fiction, second-rate books with cover blurbs proclaiming their outstanding merit are everywhere. The publishing machine churns lots of rubbish too. And even the authors of great books can display their limitations if you follow them on X. Understanding one part of the world does not mean you understand it all. So, forget social media, check out our book reviews each issue. At Watchdog we do our best to find and review the best new books on politics and economics. We know not everyone has time to read all these great books, so enjoy our short summaries of the latest quality reads.

CARELESS PEOPLE Read this book! "Careless People" is a great insider-expose of Facebook - and author Wynn-Williams is a Kiwi too, a great storyteller, who talked her way from NZ diplomacy to become global policy director at Facebook. Who else, tasked with "showing Javi a good time" (Facebook's Head for Growth, Javier Olivan), at an early meeting of heads of world governments in Colombia, would organise a bicycle tour of beaches and cafes?

Starting with a truckload of youthful idealism, she lived a crazy-busy globe-trotting life, but the global damage done by Facebook - and Zuckerberg's complete lack of interest in anything other than growth - became clear over time. Quote: "Most days, working on policy was less like enacting a chapter from Machiavelli and way more like watching a bunch of 14-year-olds who've been given superpowers and an ungodly amount of money, as they jet around the world to figure out what power has bought and brought them".

Readers of the excellent earlier Facebook expose "Broken Code", which I wrote about in Watchdog 167 (December 2024)*, will already know what going for maximum growth in user numbers all round the world really meant; creating a tool where billionaires, corporations and dictators can pay so their preferred content gets maximum viewings on social media. *"Social Media. A Toolbox For Autocrats, Insurrectionists, Scammers And Misogynists", Ed.

The particular angle that pushed Sarah Wynn-Williams to turn whistleblower was Facebook's ongoing attempt to get into China by adding a political censorship system to their version of Facebook. They added automatic detection of restricted terms, an option to shut down the site during civil unrest, considered reducing privacy protection for Hong Kong users, provided briefings on facial recognition technology and building data centres, and finally restricted the account of dissident US resident Guo Wengui at the request of the Chinese government. They still didn't get into China.

Reading About These Corporate Misdeeds Is Not Dry

There's so much more in this book. Here's a selection of chapter titles, to give just a taste of Sarah's career learnings in Facebook:

The great thing about "Careless People" is that reading about these corporate misdeeds is not dry. You can laugh at the outrageous stories, get to know the characters along the way, share in Sarah's early naivete. At the end though, the damage done across the world becomes crystal clear. Close your Facebook/Meta/Instagram account today! "Careless People" is available for $40 at Whitcoulls and Paper Plus.

THE BIG MYTH "The Big Myth" is the second-best book I read for this issue, after the brilliant "Careless People". It's very well researched and written, uncovering plenty you probably don't know about the calculated work of US business over many years to convince Americans to hate Government and trust markets. To their great credit, the authors also go beyond corporate manipulation to delve into how and why Keynesian* economics went into decline from the 1970s. *John Maynard Keynes (1863 - 1946) advocated Government spending on public works to stimulate the economy and provide employment. He was the most influential Western economist for several decades after World War 2, until he was supplanted by the monetarists. Ed.

It is easy to show how clandestine corporate manipulation of public perceptions underpinned free-market fundamentalism going mainstream, but many countries struggled to deal with stagflation after the oil price shock. The economic and social consequences of that crisis opened the door for neoliberalism, so it's important we look back again at those difficult economic problems, and ask what we can learn with the benefit of hindsight and 50 years of experience. Put like that though, it is obvious that much more work should have been done on this critical question. Economists have this blind spot for their past failings when there is so much money to be made in the present...

1970s: Complex Problems Require Complex Solutions - And Clear Public Messaging

After the introductory coverage of American corporate propagandising, a chapter titled "The Dawn Of Deregulation" gives a very thoughtful analysis of the complex problems America - and the world - faced in the 1970s, and the political failure to negotiate an effective response. The authors argue it was this political failure which created an opening for the rich to reshape economics.

Like me, you may remember stagflation as the description of the problem, and high interest rates as the preferred solution. In the USA, prime mortgage rates peaked in December 1980 at 21.5%. New Zealand's floating interest rates were increased later, to 20% in March 1985, and I remember it well because a friend of mine lost their home in a mortgagee sale.

Before then, inflation had been associated with economic expansion, so while earlier inflation caused some problems, the growth provided balancing compensation. In the 1970s unemployment peaked at 9%, the highest rates since the end of WW2, alongside double-digit inflation. Nixon tried wage and price controls, and after his resignation Ford declared inflation "public enemy number 1", though he introduced only voluntary responses. Neither helped reduce inflation much, and unemployment was not targeted at all. Spending money on jobs programmes would have helped, but that would increase debt, which at the time was perceived as inflationary.

Stagflation had multiple causes. Oil shocks were the obvious one; Nixon's abandoning of the gold standard added to inflation; rapid growth in international trade was another, as West Germany and Japan grew to outcompete the US; and key US unions like the Teamsters, which benefitted from regulation which encouraged trucking to break the earlier railroad monopoly, expected pay rises regardless of productivity increases.

When Carter became the next US President his key advisor was Alfred Kahn, an economist who still believed in the power of institutions and regulation to foster technological change and drive economic growth. His published magnum opus was "The Economics Of Regulation", where one of his key case studies was energy markets, as critical then as they are now and in the future. He pointed out that early regulation gave large power users cheaper rates, encouraging both consumption and pollution. This drove investment and growth when introduced, but after oil prices went sky-high a rethink was required.

Kahn argued for pricing to vary with demand, to reduce the high cost of building inefficient peak-only plants, and to include social costs in pricing to reduce pollution. Looked at from today, Kahn represented the best thinking of his times. As the authors put it: "They showed that it was possible for Government to learn from experience, respond to evolving technologies, and make midcourse corrections, while neither being trapped in an obsolescent paradigm nor forgetting the lessons of the past".

Looking back with hindsight, the Carter era gives a glimpse of what could have been: a future in which some of the excesses and bluntness of the earlier New Deal were corrected, without swinging the pendulum too far in the other direction. But it also shows how antiregulatory, antigovernment ideology had also seeped into Democratic thinking, laying the groundwork for the excessive pendulum swing that followed. We commonly hear that business-friendly deregulation and skyrocketing inequality started with Reagan, but that shift began under Jimmy Carter.

Politics Trumped Economics

To win election, Carter sought "to combine strong safeguards for consumers with minimal intrusion of Government in our free economic system. We Democrats believe competition is better than regulation". And he was right to emphasise the need for reduced pricing regulation, coupled with new regulation which encouraged more socially effective competition. Blunt earlier legislation had over time led to distortions in the economy which significantly limited both efficiency and competition.

But the reforms proposed by Carter, Teddy Kennedy and Kahn fell at the political hurdle. After a lot of back-and-forth debate in Congress, his broad effort to combine reform and conservation was reduced to grants for insulating low-income homes; taxes on heating oil and gasoline were dropped, while gas pricing regulations got more complex but less effective.

Airlines were the other main area which Carter and Kahn combined to deregulate. Viewed from a pricing perspective, deregulation was very successful with average fares dropping by half, flight use increased and more staff were hired. But the US economy was returning to the boom-bust cycle of times past. Many airlines went bust, the big became much bigger, wages fell, and airlines didn't stay competitive. Today, US airlines are a case study in monopsony*, with four major competitors, but each dominates the market in their region. *A market situation in which there is only one buyer. Ed.

Meanwhile, the neoliberal solution of pushing interest rates sky-high crushed the economy from 1980-83, and the unions. "By the time the recession was over, the world had changed again: foreign policy in the Persian Gulf states had been transformed by the Iranian Revolution of 1978-79 and then the Soviet invasion of Afghanistan in 1979, and the resulting Carter Doctrine - which included permanent stationing of US military forces in the Gulf".

"There would be no more oil embargoes. In fact, an oil glut would drive prices down throughout the 1980s." Keynes was out, rethinking regulation to foster competitive markets was out. Deregulation was normalised, market domination became the name of the corporate game, "independent" (pro-business) setting of interest rates by the Reserve Bank replaced Government spending as the preferred response in crises.

Tax Changes Power Up Inequality

"The growing power of the business lobby, and the concomitant waning of labor influence in American politics, is nowhere more visible than in the 1978 Revenue Act. During the preceding decades, American tax policy had become more progressive, with higher rates for higher earners and lower, or zero, rates for lower-income people. But industrialists hated this, and the relatively new (and, until 1978, relatively moderate) Business Roundtable, a group designed to mobilise CEOs (chief executive officers), revived an old National Association of Manufacturers' argument against progressive taxation: capital formation and investment (would fall)".

The Business Roundtable blamed falling productivity on falling investment and a capital shortage. Union leaders agreed there was a shortage of investment, but pointed out this was driven by companies investing more of their capital overseas. Meanwhile, Carter had been elected on tax reform, promising to close loopholes that allowed the wealthy and well connected to avoid taxation. He proposed increasing the tax on capital gains, which was lower than the tax on earnings for most wage-earners. But when a Republican introduced an amendment to lower the proposed capital gains tax increase, encouraged by an electronics industry lobbyist, Carter began to lose Democratic votes for the legislation. The haggling began.

The capital gains tax increase became a big decrease, and since Carter wanted his tax reform to be revenue neutral, he abandoned middle-class income tax relief for inflation too. Another tax instrument, the investment tax credit, could have been expanded to ensure reinvestment in the US, but it wasn't, so US investment continued to flow abroad.

While reading this book, I learned that this cross-party political haggling was a recurring theme in Congress. On many of the key economic changes which underpinned deregulation, legislators didn't vote on party lines. Presidents had to gather support from both sides, resulting in laws that were much less effective. Today, economists like to credit Carter's choice for a new Chairman of the Federal Reserve, Paul Volcker, with ending inflation. He did, but at the cost of crashing the economy. A better mix of policies would have achieved the same result with less damage.

Now the Federal Reserve had primacy in macro management of the economy, making low inflation rather than low unemployment the primary economic goal. Way back in 1926, economist Irving Fisher had highlighted the inverse relationship between inflation and unemployment, so this new preference for low inflation was also a preference for higher unemployment, conveniently a driver of lower wages.

Magical Thinking

Moving on to the Reagan era and beyond, the authors trace the roots of recurring financial crises and bailouts in deregulation, and also take a closer look at the outcomes of free trade agreements, concluding, for example, that NAFTA (North American Free Trade Agreement) produced much more modest economic gains than claimed by its advocates, with much larger distributional effects which transferred income from blue-collar workers to the owners of capital.

"Government is not the solution to our problem; Government is the problem," as Reagan famously declared. Reagan's style of Government was certainly a problem. The recession dragged on to 1983 with no sign of the promised investment-led growth. The "supply side" story that tax cuts would finance themselves was proved wrong, but the conservative mantra didn't change. Tax cuts to stimulate the economy were the Republican gospel.

The authors are most scathing about the intersection of pro-market ideology and climate change, titling that chapter "Magical Thinking". By the 1980s, scientists had identified multiple major environmental threats - acid rain, the ozone hole, and climate change - which sprang directly from market failures. There were simply not enough costs attached to the corporations which profited from pollution.

Rather than admit that the ideology was wrong, or at least incomplete - that markets could not solve all our problems, and that in cases of market failure Government might be an essential part of the solution - the Reagan Administration responded by cutting the budgets of environmental protection agencies, while misrepresenting or disparaging the science. That came easily to the man who once claimed publicly that "trees cause more pollution than automobiles do". In speech after speech, he claimed that trusting "the magic of the marketplace" would solve everything.

Changing The Gospel

In this review I've focused on the failures of neoliberalism and what we can learn from history, but there is one other angle in this book I hadn't read about before, and which is very relevant to the USA today. That's the story of how business reshaped American religion, told in a chapter titled "A Questionable Gospel". Here's an early example of how business patronage worked.

James Fifield was a minister in Los Angeles, taking the pulpit of the First Congregational Church in 1935 just after it completed a major expansion with a $US750,000 mortgage. His message was not just spiritual; it was also economic and political. He demanded the clergy lead a revival of "individual thought on a wide-spread scale" to prevent American descent into "the abyss of totalitarianism". By 1940 he was invited to speak at the National Association of Manufacturers' annual congress, and in 1942 "Spiritual Mobilization" was incorporated, with a mailing list of 23,000 ministers.

"In 1943, Sun Oil president J Howard Pew increased his donations to Spiritual Mobilization, but first, he did some homework, hiring economist Alfred Haake to investigate the organisation. Haake saw the potential to recast religion; 'Christ or Caesar' became 'Freedom vs Security', 'Capitalism vs Communism'. Pew added influence to incentive, putting Haake on the board and introducing Fifield to other 'captains of American industry'". This story of business influencing religion flows right on up to today's conservative churches.

Patronage At Work

Returning to the book's opening chapters which trace clandestine corporate manipulation of public perceptions and, you know Ronald Reagan started in films, but did you know he only became famous through hosting General Electric Theatre, a weekly prime-time TV show funded by industrial giant General Electric? Did you know that "Little House On The Prairie" was heavily manicured by the author's daughter, Rose Wilder Lane, to emphasise libertarian themes, with Lane going on to write one of the classics of libertarian self-publicity, "The Discovery Of Freedom", notable for its heavy use of blunt assertions and disregard for facts?

Did you know that private backers paid $US15,000 per year for ten years to secure Friedrich Hayek's* tenure at the University of Chicago's Law School, after their Economics Department refused to hire him. The University of Chicago was nurtured/funded through the Free Market Project to create today's home of Rightwing economics. *Friedrich von Hayek (1899-1992), a reactionary economist who opposed the Welfare State and championed market forces. Ed.

"The Big Myth" gives you the full story of the calculated way business manipulated the public to get today's distrust of Government, the only institution which stopped them from maximising profits by disregarding social costs. Many business-funded organisations have worked across all levels of American life to manipulate public opinion.

Spiritual Mobilization was funded by Sun Oil to convince Christian clergy that unregulated capitalism was founded on Christian values; the Ayn Rand* Foundation donated 400,000 copies of her books to Advanced Placement high school programmes; this depressing list could go on and on, but you get the picture. *Ayn Rand (1905-1982) was a writer and philosopher who championed laissez faire capitalism. The patron saint of today's libertarians. Ed.

Back in the early 20th Century, Americans had been rightly suspicious of "Big Business" given its track record of abuse, and saw the Government as their ally. By the later decades of the century, this had flipped: many Americans admired business leaders, while seeing the Government as dead weight, taxation as unfair or even a form of theft. Quiet, steady persuasion and propaganda had done their job.

That's The USA, So How Is Aotearoa Doing?

We don't face the extremes of the US corporate-political-economics-military alliance, but many of the same neoliberal policies shape our economy too, while the steady rise of lobbying influence and funding is not being addressed, and depth in our policy making teams is being replaced by centralised power in the Department of Prime Minister and Cabinet.

"The Big Myth" emphasises the critical role of good economic policymaking and regulation, which implies we need big changes in how we create good policy. Meanwhile, our coalition Government dissolved the Productivity Commission, plans permanent annual reductions in public service capacity, and introduced the Regulatory Standards Bill to privilege corporations over people.

We desperately need a wide-ranging rework of how our Government develops and promotes good policy. That's a big ask - clearly it needs some combination of better funding for both the public service and academic-specialist research and expertise; better public consultation and democratic input; and better communication to win public support. Can we do that? I hope so, because if not it's down the gurgler we go with climate change disaster, rising corporate power, and authoritarian government.

I hope so, because if not it's down the gurgler we go with climate change disaster, rising corporate power, and authoritarian Government. The most positive signs so far are the rising clarity among unaligned economists that neoliberal economics is bad economics, and the very poor performance of their policies when applied. They may control the wealth and the hype, but their real-world results aren't inspiring confidence.

Finding The Book

"The Big Myth" is available to preorder in paperback for $38.70 on The Nile. Otherwise, check your local library or splash out for the hardback ($57.89 delivered, by Book Hero). This is an in-depth book for readers searching for answers on what good policy really looks like in complex times, to counter corporate power and influence in economic debate. If you just want a short overview of neoliberal propagandising and how the Left can counter it, try "The Invisible Doctrine" by George Monbiot and Peter Hutchison, which I reviewed in Watchdog 168 (April 2025). It's only $31.99 for the hardcover through Whitcoulls (though they may have to order it at your request).

PLUNDER "Plunder" ran a very close third to "Careless People" and "The Big Myth" as my favourite new books. It is an excellent follow-up to Brett Christophers' superb "Our Lives In Their Portfolios"*, which broke the story of how giant private equity firms like Blackstone work. Their main business model is to draw other peoples' capital into fixed term funds which buy assets, then maximise short term profits while extracting high fees. The result is assets loaded with debt, increased prices to consumers for reduced services, then the portfolio is sold on for capital gains. *Reviewed by Linda Hill in Watchdog 164, December 2023, Ed.

Taking large rental portfolios as an example, the result is permanently higher rates of extraction by landlords from tenants. The next company owner has bought a huge portfolio of homes at pumped up prices, so must continue charging higher rents to get a return on the now-overpriced asset. Meanwhile, the "asset managers" have moved on to buy up a new set of homes for short term profit.

And in recent years, private equity has been expanding its scope, buying up retailers, medical practices, for profit education, insurance, retirement funds, private credit, prison services, nursing home chains, mobile-home parks, etc, with devastating impacts. Ballou is blunt about the active support of the American government in this process. There is so much short-term money to be made, it's no problem to divert a little to politicians who smooth the way for this business model.

How big are they? Ballou recently said in an interview: "When you look at the number of employees that these portfolio companies employ, Blackstone, Carlyle, and KKR, not necessarily in that order, they would be the third, fourth, and fifth-largest employers in the United States behind just Walmart and Amazon". Brendan Ballou is a federal prosecutor and served as Special Counsel for Private Equity at the US Department of Justice. He has plenty of ideas on what to change to prevent these abuses. There are still professionals in America who see the damage done and speak out - but don't hold your breath waiting for effective regulation of private equity there. It's all downhill in the USA lately.

Even in tiny New Zealand we should watch this trend. New ways to make high profits can expand dangerously quickly. Rember those obscure American housing derivatives. We'd only just heard about them in 2007 and bingo, global financial crisis. In addition to their cost-inflating service-reducing business model, asset managers are also notable for their lack of ethics and their lack of relevant management expertise.

They purchase whatever new businesses they perceive as underpriced, particularly those that deliver services to the poor, because the poor have less options when prices are hiked. And private equity specialises in externalising the risks to other parties - think public private partnerships where the Government picks up the bill for cost overruns. Ballou tells many scary stories from personal experience.

Prisons A Captive Audience

"Over the past two decades, New Zealand's dairy and meat industries, led by powerful lobby groups like Dairy NZ and Federated Farmers, have effectively stalled efforts to regulate agricultural emissions through a combination of political influence, disinformation campaigns, and promises of future technological solutions".

American prisons are increasingly run by private equity firms. They like prisons because a) there are steady cash flows from Government contracts; b) with a literally captive audience, you can cut costs and services without consequences; c) prisons are run by Government agencies that can be co-opted to become firms' allies and advocate.

So today, you may pay a fee for every minute you read an e-book from the prison library, and if you get sick a private company service will be your only option. Privately run phone companies will pay to provide prison phone services, because they can extract such high charges from inmates and their families. Costs of $US12 per 15-minute call were common, and of course there are add-on fees for prison payment cards. One study found a third of all family members went into debt to pay for calls.

Years of grass roots lobbying struggled to slow this extreme exploitation, while the Sheriffs' Association listed a big private prison phone company as a diamond-level sponsor and became one of private equity's most vocal advocates. When Barack Obama appointed a sympathetic Commissioner to the Federal Communications Commission, he edged closer to regulating the crazy cost of private prison calls. Then Trump appointed a former Verizon (phone company) lawyer as the new Chairman; one week later the new appointee announced they would not defend much of their existing regulation, and forget any improvements.

Turning Our Homes Into Businesses

Recurring claims by private equity are that its use of debt and focus on short term profits incentivise excellence; that the intelligence of its leaders improves outcomes for companies. This corporate public relations nonsense is so laughable, a mirror image of reality. Ballou provides case after case of wrecked companies going bankrupt, and the only expertise shown is in financial manipulation to extract cash and legal expertise to exploit regulatory loopholes.

For example, in 2006 the private equity firm Fortress purchased a small mortgage servicing firm and renamed it Nationstar, applying the standard private equity rollup model to hoover up smaller companies with billions of dollars of mortgages, so it serviced three million loans by 2020. Fortress was suddenly the largest non-bank mortgager in the US and the third largest overall.

But Nationstar struggled with the basic tasks of servicing its mortgages, repeatedly losing customer files and recording inaccurate information, often failing to detect its own errors until after foreclosures began. It was eventually forced to settle lawsuits in all 50 states (while of course admitting no wrongdoing). A study of another large property manager owned by private equity, Colony, found it routinely used eviction notices to ensure excessive rents were paid, threatening to evict one third of all its tenants in a single year. The rapid acquisition of property by private equity was a disaster for homeowners, but it sure was lucrative for private equity. Fortress, which bought the company for $US450 million in 2006, and sold it for $US3.8 billion in 2018.